Compass Tech has surveyed and published the market report on the out of home advertising industry (OOH) for quarter 4 of the Ho Chi Minh City. Provide overview data on the industry; useful market value to brands and Agencies; serving for the implementation plan of OOH advertising on Tet 2021.

OOH market overview in the fourth quarter of 2020

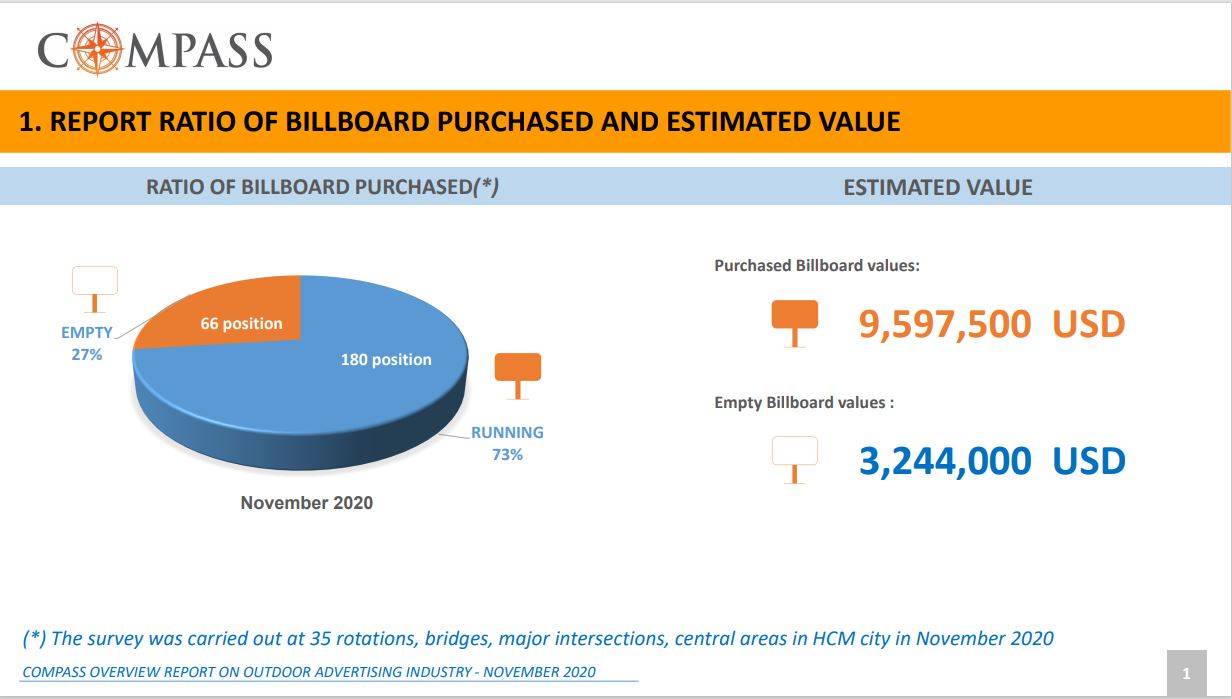

In November 2020, Compass Tech surveyed 35 rotations, bridges, major crossroads, central areas in Ho Chi Minh City, collected more than hundreds of outdoor billboards in Ho Chi Minh. With a large number and concentration boards (sample); the report shows an honesty view of the implementation of OOH advertising of brands; in the context of a year affected by the Covid-19 pandemic.

Accordingly, the total value of the billboard in Ho Chi Minh City up to 13 million USD. Of which, the billboard purchased was up to 9,599,500 USD, accounting for 73% of the total number of billboards; equivalent to 220,788,500,000 VND. The value of the blank billboards is 3,244,000 USD, accounting for 27% of the total number of billboards; equivalent to 74,612,000,000 VND.

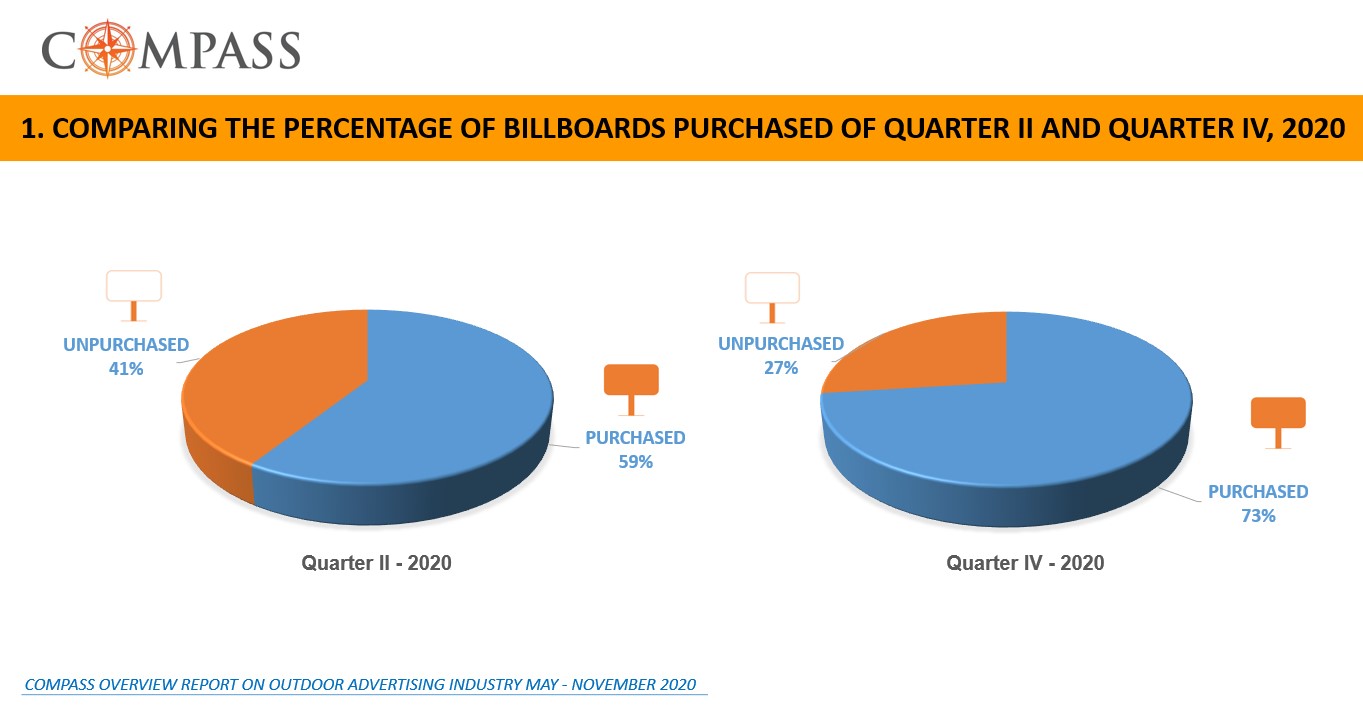

Compared to May 2020, the blank billboard rate has decreased significantly (from 41% to 27%). The reason that has helped the OOH advertising industry in Vietnam tend to recover is the control of Covid-19 pandemic and the upcoming Tet season. This is a preparation step for the OOH industry to develop to serve the New Year 2021.

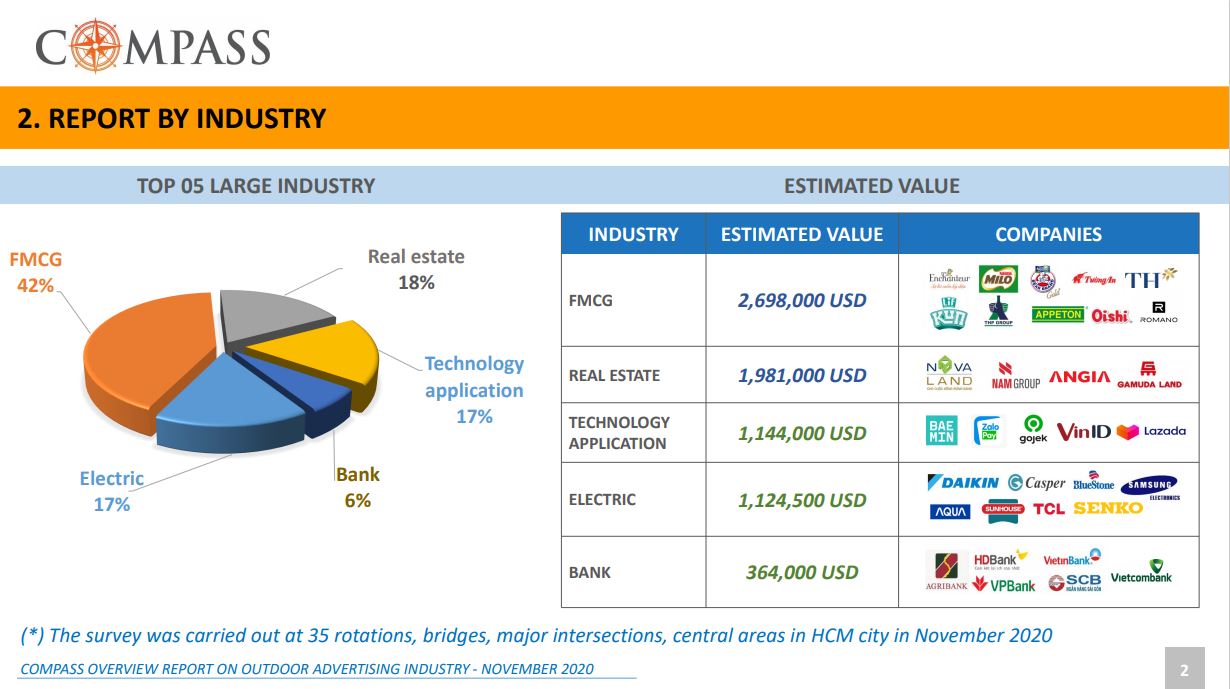

Top 5 outstanding industries in Ho Chi Minh

FCMG

Like the previous quarters; FMCG has always been the industry that buys the most billboards in Ho Chi Minh City. FMCG accounts for nearly “half of the OOH pie” with 42% of the total number of billboards. Typical FMCG brands running an advertising campaign in the market are: Milo; Appeton; Romano; Enchanteur…

Real estate

The real estate industry at present has used many billboards; mainly concentrated near apartment buildings, brand’s new projects. If compared with May 2020; real estate has increased 18% rate of OOH advertising. Typical brands of the real estate industry are running advertising campaigns: Novaland, An Gia, Gamuda Land, Nam Group…

Banking

Compared to the previous Covid-19 pandemic, the banking industry accounts for 18%, by the end of 2020, the banking industry has decreased to only 6%; mainly concentrated in central areas, lightbox, banners … Big banks still advertise outdoors such as: Vietcombank; VP Bank, Agribank, Vietinbank…

Electronics

As predicted by Compass Tech; the electronics industry focuses mainly on the summer months. Therefore, the electronics industry has reduced the use of outdoor advertising from 22% to 17%. Although the number of signs has decreased; but the electronics industry still has many competing brands such as Daikin, Casper, Bluestone, Samsung, Senko…

Technology application

Because the Covid-19 pandemic has not yet vaccine, this is the time for the technology application industry to take the throne. Customers will prioritize buying and paying online; the trend of using technology vehicles has helped the technology application industry slightly increase by 2% (from 15% to 17%). Outstanding industries include: Baemin, Zalo pay, Gojek, Lazada…

Highlights in the OOH advertising market for the fourth quarter of 2020

Compared with the same period last year, 2020 has seen many new changes; reshape the market this year.

– Major brands of FMCG industry familiar with the OOH advertising market many years ago almost disappeared in the billboard market this year such as: Cocacola, Vinamilk, Pepsi…

– Unilever is a large corporation in the world that has cut the OOH advertising budget in Ho Chi Minh City; Unilever’s missing brands in Q4 2020 were: Lifebuoy, Omo, Dove, TRESemmé, Knorr, Sunlight, Comfort…

– The impact of the covid-19 pandemic is arguably the main reason why the banking industry is cutting advertising budgets later this year.

– Grab – a big player in the market is no longer seen on the OOH market in the fourth quarter of 2020. Instead it was Gojek, Beamin has increased its outdoor advertising campaigns to gain market share in the Ho Chi Minh City market.

– Many brands switch to a short-term OOH advertising campaign (less than 3 months) to cut costs; suitable for the rapidly changing market today.

Predict the Tet market in 2021

From the survey and analysis of the OOH advertising industry; Compass Tech predicts that the Tet 2021 market will not be as exciting as in previous years. Big brands will still have limited advertising budgets due to lower revenue. However, this is also an opportunity for small brands to have good locations; dominate the market with short-term campaigns.

Compass Tech’s detailed industry reports

These are the most comprehensive figures surveyed and analyzed by Compass Tech for the OOH advertising industry in Ho Chi Minh City. In addition, Compass Tech also provides OOH advertising industry reports for businesses by industries and brands, this helps the companies know what other brands are running in HCMC. The detailed report will provide businesses with important information such as: The positions of the billboard of brands; the value of the billboards; Opportunity to contact (OTC); Visibility adjusted contact (VAC).

Click here for the full Reporting on OOH advertising industry in the fourth quarter of 2020

Contact Compass Tech to receive a detailed report via Hotline: 0933 15 99 88 or Email: [email protected]